can owing back taxes prevent you from buying a house

When the property taxes are not paid the governments take steps to collect that money. A federal tax lien doesnt automatically keep you from buying a home.

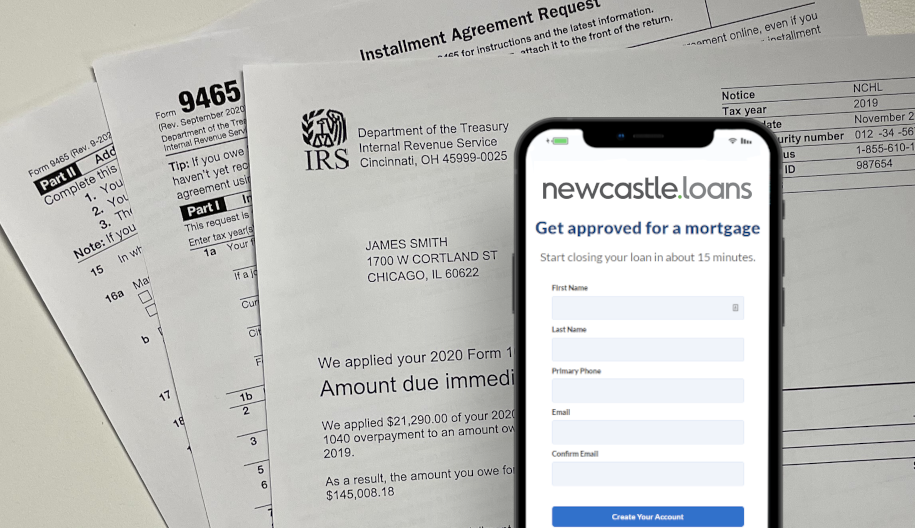

Can Unpaid Taxes Stop You From Getting A Home

Due to the Tax Cuts and Jobs Act the amount you can deduct depends on when you.

. Yes these property tax auctions are. Mortgage lenders realize the risks that come with owing the IRS money and what measures this federal agency can use to recoup outstanding tax balances. The answer to this question is yes.

Although you can technically buy a home if you owe money to the IRS you may have trouble selling the home you already have. Tax liens debt servicing and lack of security are all ways owing the IRS affects buying a house. That goes doubly when you can avoid capital gains taxes.

For most sellers it can be a matter of signing the. The good news is that federal tax debtor even a tax liendoesnt automatically ruin your chances of being approved for a mortgage. There are two types of qualifying agreements for your tax.

So if you earn 5000 a month and make a 300 a. You can improve your chances. If there is a federal tax lien on your home you must satisfy the lien before you can sell or refinance your home according to the IRS.

If youre not ready to give up on the house of your dreams call SH. Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. As long as youre paying off your debt the fact that you got.

Owing taxes or having a tax lien does make it harder and more complicated to get a mortgage. If you do not pay your taxes in time after the IRS has assessed your tax liability and sent. Does owing the IRS affect buying a house.

Owing back taxes isnt an automatic deal-breaker when you apply for a Federal Housing Administration FHA mortgage. Tax liens from unpaid taxes can make the process. Run your taps for two minutes to flush out lead households told.

In a Nutshell. Below 43 percent is good above 43 percent is bad. It can also help to prevent you from being underwater owing more than your home is worth if market conditions change.

Manage your tax debt with the tax specialists at Key Tax Group. The answer to this question is yes. The IRS can seize some of your property including your house if you owe back taxes and are not complying with any payment plan you may have entered.

First the IRS doesnt generally file a tax lien. There are however more hoops youll have to jump through compared to someone who doesnt have any. Yes you might be able to get a home loan even if you owe taxes.

The IRS can seize some of your property including your house if you owe back taxes and are not complying with any payment plan you may have entered. If you owe more than 25000 to the IRS and have had a lien placed against your assets the tax specialists at Key Tax Group. Yes you might be able to get a home loan even if you owe taxes.

But if you owe taxes can you buy a house. In short yes its possible to buy a house if you owe money to the IRS. Well discuss each point more in-depth below.

When tax liens are involved it can make the process a stressful one. They do not want to loan money to. Unless you owe more than 10000 and youre not in a qualifying agreement.

When you are buying a house by paying back. If you owe back property taxes the taxing authority gets a lien on your house for the amount due plus any. This is done by selling the past due taxes at a public auction.

For instance 43 percent is a common threshold for mortgage programs. You can also take advantage of the standard deduction. To get approved for a conventional loan you cant plan to buy a house in the county where your tax lien is reportedregardless of any payment plan you might have in place.

:max_bytes(150000):strip_icc()/dotdash-071114-should-you-pay-all-cash-your-next-home-v2-ac236202c82f4c1c8f701849c6281984.jpg)

Should You Pay All Cash For Your Next Home

5 Things To Know About Buying A Property With A Tax Lien

How Your Credit Score Impacts Homebuying Nextadvisor With Time

Tax Day Is Today What Experts Want You To Know If You Haven T Filed Nextadvisor With Time

You Don T Have To Pay Your Back Taxes To Get A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

Can You Get A Mortgage If You Owe Back Taxes

Can I Buy A House Owing Back Taxes Community Tax

Can I Buy A House Owing Back Taxes Community Tax

Can You Buy A House If You Owe Taxes Credit Com

Tax Sale Vs Sheriff S Sale What Investors Need To Know Stock Leader

Georgia Property Tax Liens Breyer Home Buyers

Can The Irs Seize My Property Yes H R Block

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

What You Shouldn T Do If You Owe The Irs Smartasset

500 Properties Philly Sold For 1 Are Blighted Or Owe Nearly 900 000 In Back Taxes